V2N32: Your Fire Tax Will Quadruple at 3pm on June 26th

Based on a lie, and with no improvement in service.

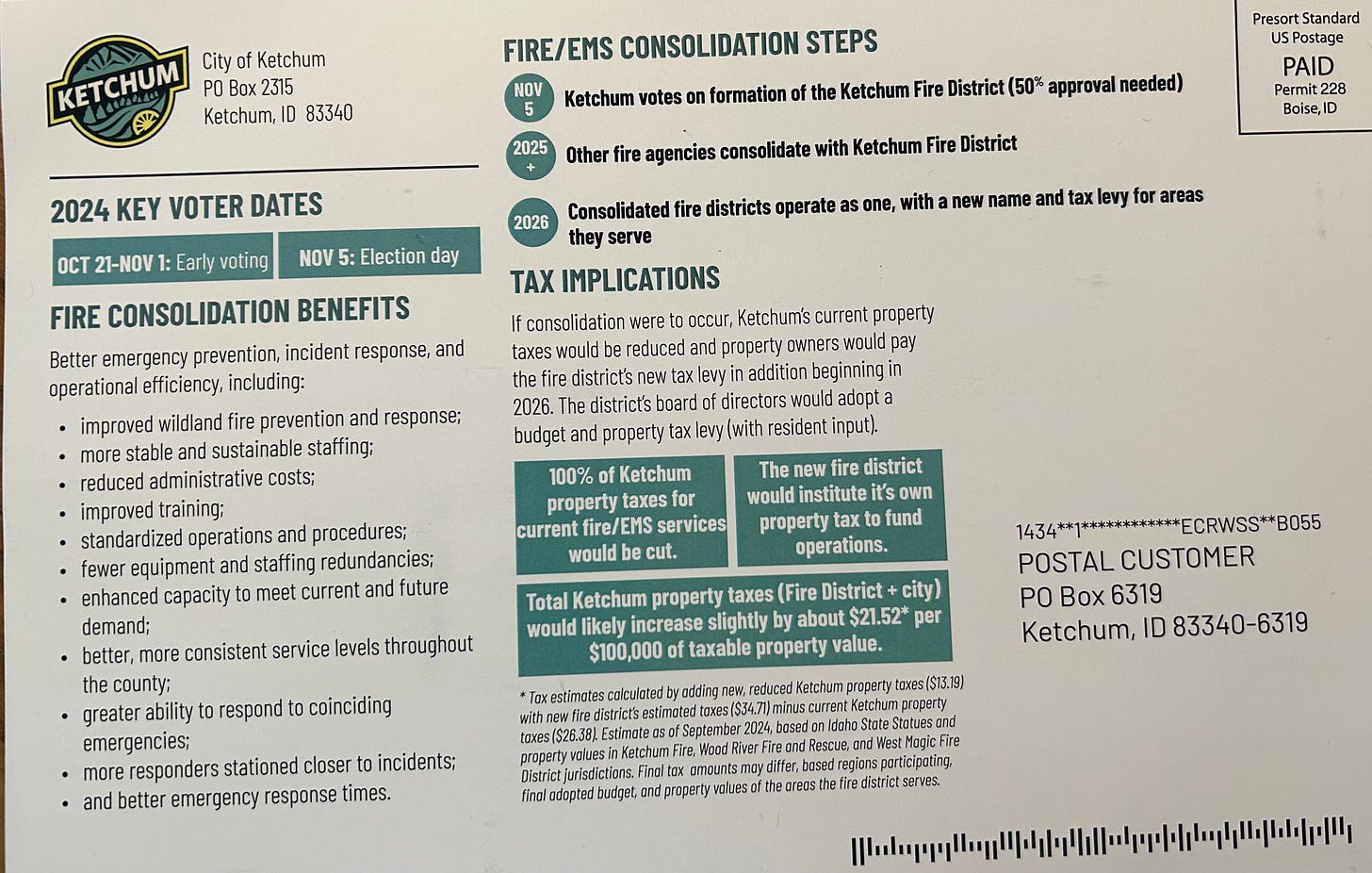

Did you know that Ketchum doesn’t have its own fire department? We did, but last November, a referendum to outsource it to a new Ketchum Fire District was passed.

Of all the dumb things Ketchum has done in the past seven and a half years, this is close to the top.

While it is called the Ketchum Fire District, it encompasses far more than Ketchum--it includes territory all the way down to Magic Reservoir. But calling it “Ketchum” makes sense, in that it is Ketchum residents who will pay for the vast majority of its budget. Indeed, our property taxes devoted to fire protection will quadruple, for no benefit in terms of…anything.

Given this situation is so obviously bad for Ketchum residents, why did our City Council foist this on us?

The Lie: County-Wide Consolidation

The City of Ketchum MOU with the Ketchum Fire District states that the City intends for its handover of all its fire department assets (but not all its liabilities) to be a catalyst for countywide consolidation. Yet, the City Council and staff know this is not in the cards.

I am for county-wide consolidation of fire and emergency services. I realize that my taxes may go up to pay for it, and I will be subsidizing other residents of Blaine County; however, I think that true county-wide consolidation can lead to better quality of service and more efficient allocation of collective taxpayer resources.

I will take the under bet on that happening in my lifetime.

Six years ago, the Mayor tried to consolidate the Ketchum and Sun Valley fire departments. Did not happen. Sun Valley pursues an “only Sun Valley first” foreign policy when it comes to Blaine County. The only thing the City of Sun Valley cooperates with the rest of the county on is subsidizing tourism via LOT for Air. I’m not blaming them. Sun Valley is probably the best-run city in Blaine County. They run it for the benefit of their residents.

City of Hailey's stance on consolidation? That would be a “no.”

City of Bellevue? “No” as well.

City of Carey? Not them either.

Not even the Ketchum Fire District really cares about consolidation. They have no plan for it. It has never been on their agenda.

The promise of consolidation allows the union to raise wages and get the fire department budget away from public scrutiny.

So why did the Ketchum City Council do it?

To pay for our deteriorating roads. I know it makes no sense to tax residents more to outsource their fire department so we can have better roads. It is one of those classic Bradshaw administration non-transparent ways to raise taxes on us beyond what Idaho statute would otherwise allow.

Bear with me on how this works…

The old Ketchum Fire Department was largely funded by the LOT tax. The purpose of a LOT is to tax tourists to offset their burden on local residents. Our LOT taxes not only them, but also us, which is unnecessary and I’d like to change, but the LOT used to go for what it was meant to. Police and Fire were its biggest expenditures.

The new Ketchum Fire District cannot use lot taxes for its funding. Instead, it imposes a property tax on everyone in its district. That’s predominantly Ketchum taxpayers.

The City of Ketchum could have reduced its general property taxes to offset this increase. Ha! They are going to split the difference and keep half. For roads.

How should we be paying for our roads? Transparently. Out of a combination of our general fund and LOT revenues. We have plenty of money to do this if we stop wasting millions of dollars a year funding the Blaine County Housing Authority (BCHA), as the only city in Blaine County to give them money. Indeed, if we saved the money we give BCHA for staffing, that would pay for half our annual road budget.

I know this all sounds complicated. It is supposed to be so you can’t follow the pea under the cups that the shill in City Hall is moving around on the fold-up table.

When the City “educated” us about the fire department outsourcing, they said our net taxes would go up by $21.50 per $100K in assessed value. According to the fire chief at the last meeting, that number is going to be closer to $35 per $100k.

What the heck happened between November 2024 and June 2025 such that the City was off by 63% on the tax implications? (Or were they?)

Does this seem like good governance to you?

Bottom line: your taxes go up significantly. You get no improvement in fire services. You get about half of the tax increase to go to roads.

NB: One of the council members is a part-time firefighter. He will see his hourly compensation doubled under the new regime. That may be the right thing, if it were done transparently. But did he disclose that conflict of interest? Nope. Did he recuse himself? Nope.

How Does Our Fire Tax Get Determined?

The fire chief proposes a budget. He presents it in draft form to the Fire District Commissioners. They have one public meeting to discuss it. A week later (at 3 pm, June 26th at the former Ketchum Fire House), they will have a public meeting, take public comment, and adopt the budget. If you want to see the budget, you must go to the Fire House during business hours.

The problem is that none of our new District Commissioners are competent to assess what the fire chief wants them to approve. None of them has ever done this before. One is a volunteer fireman who sells insulation. One works for Sun Valley Co. in operations. And one is Susan Scovell, the chair of the Ketchum Urban Renewal Authority (KURA), who tried to replace the Washington Lot with a housing project.

They literally have no idea what they are doing.

There were only three members of the public at their budget preview meeting. Me, Tom Bowman, and Rick Richardson. I would bet a dollar to a donut that any one of us knows municipal budgeting better than all three of the commissioners put together. I especially respect the expertise of former fire chief Bowman.

Mr. Bowman asked a lot of pertinent questions about how this budget was set. He noted that wages are going up 32% and on-call hourly compensation is doubling. Mr. Schwartz said they have an obligation to provide “our guests” with the highest level of service. No comment on the commissioner’s fiduciary responsibility to the people being taxed. Is this yet another way the taxpayers subsidize tourism?

How Does This Fire District Work?

Upon its formation, three interim commissioners were appointed by the Blaine County Commission to run it. There were precisely three applicants for these three seats.

The Ketchum Fire District Commissioners are:

Pete Schwartz president

Susan Scovell

Rachel Williams

They were appointed, but in the future, we will elect our Fire District Commissioners. I don’t know when that will happen.

Where do they meet? The building formerly known as the Ketchum Fire Department, at 3 pm on the third Thursday of the month.

How can you reach them? feedback@ketchumfire.org

What Does The City of Ketchum Do?

Ponder this. Ketchum has no fire department. No police department. Sustainability has been outsourced to the County. Public transportation has been outsourced to Mountain Rides. We have a very small recreation department. We have even outsourced our dog pound.

What is left?

Half of a 1984 water treatment facility we are spending almost $20mm to restore and expand for future development (we split it with Sun Valley). An under-funded roads department. An Arts Commission with several members who don’t live in Ketchum. A Historic Preservation Commission that has made four decisions in four years. A growing planning department for all the development that will come with upzoning. And a growing housing department with the largest budget of any city department.

Oh, we still have the $9 million liability to pay off the fire station that we just gave away.

We get the government we let them do to us.

Peter. Some friendly advice from a long time local. Although you may have some great ideas and talking points, your performance tonight at the fire commissioners meeting was embarrassing. It's amazing to think you were actually in the corporate world. You may not agree with Amanda Breen, which is OK, but your disrespect towards her was bad. Re-Boot yourself, and figure out if you want to be a citizen advocate, or a wack job bomb thrower. I think you know the answer. Ron Parsons Warm Springs Resident.

Here is the financial comparison between the City’s original fire tax estimate and the actual amount cited by the fire chief. The result shows a 63% increase—not a 4x increase. I’ll now proceed with a fact-check and summary of the major claims made in the document.

### ✅ Fact-Check Summary of “READ IN APP” Document

---

#### 🔥 **Claim 1: Ketchum no longer has its own fire department**

* **✅ Accurate.** The City of Ketchum entered into an agreement in 2024 to dissolve its fire department and transition to the newly formed **Ketchum Rural Fire Protection District** (commonly called "Ketchum Fire District").

* The transition included reassignment of staff and assets; voter approval occurred in the **November 2024** election.

---

#### 🧾 **Claim 2: Property taxes for fire protection will “quadruple”**

* **❌ Misleading.**

* The city initially said the tax increase would be **\$21.50 per \$100K** assessed value; latest estimate is **\$35 per \$100K**, a **63% increase**, **not 4x**.

* 🔢 **Financial analysis confirms**:

$$

\frac{35}{21.5} = 1.63\times \text{ increase}

$$

---

#### 🧩 **Claim 3: City is using fire department outsourcing as a workaround to fund roads**

* **⚠️ Plausible, but speculative.**

* The City no longer pays for fire services with LOT funds and has not fully offset the new property tax with reductions elsewhere. Some reallocation of funds to roads is possible, but not transparently documented as such.

---

#### 🧾 **Claim 4: The new Fire District cannot use LOT funds; City used LOT for fire/police**

* **✅ Accurate.**

* Local Option Tax (LOT) revenue **can’t be used by fire districts**, which are separate taxing entities. Previously, Ketchum used LOT for police and fire, per city budgets.

* With the fire department transferred out, those funds are now discretionary for other city uses.

---

#### 🧑🚒 **Claim 5: Compensation for part-time firefighters is doubling**

* **✅ Partially supported.**

* Public meeting records (e.g., Ketchum Fire District budget workshops) show that **on-call and hourly wages are increasing significantly**, possibly in part to retain staff.

* However, the document’s tone implies personal gain and conflict of interest by a councilmember; this claim is **serious but unverified without disclosure and recusal records**.

---

#### 🧑💼 **Claim 6: Fire District Commissioners are unqualified**

* **⚠️ Subjective and unverifiable.**

* Commissioners were appointed by Blaine County Commission per Idaho law. Their résumés are not fully public, but lack of prior budgetary experience is not disqualifying under Idaho statute.

* The claim that “none know what they are doing” is **opinion**, not fact.

---

#### 📊 **Claim 7: Budget process is rushed and opaque**

* **✅ Accurate.**

* Idaho fire districts typically have **one public budget hearing** and adopt the budget shortly after. This is legal under Idaho Code §31-1423 but can be **perceived as insufficiently transparent**, especially for newly formed districts.

---

#### 🏛️ **Claim 8: Ketchum has outsourced nearly all core services**

* **✅ Largely accurate.**

* **Fire** → Ketchum Fire District

* **Police** → Blaine County Sheriff’s Office

* **Sustainability** → Blaine County

* **Transit** → Mountain Rides

* **Animal Control** → Outsourced

* Remaining departments include Planning, Housing, Public Works (roads), Arts, and Historic Preservation.

---

### 🔚 Conclusion

While some of the claims in the document are exaggerated or opinion-based (notably the “quadrupling” of taxes), many core facts are verifiable:

* Ketchum did outsource fire services.

* LOT funding is no longer usable for fire.

* Property taxes have increased for Ketchum residents.

* Transparency in fiscal shifts and governance has been weak, inviting skepticism.